Calculate my payroll deductions

For example say you have five employees that need to get paid while your operation is temporarily shut down. Use this handy tool to fine-tune your payroll information and deductions so you can provide your.

Paycheck Calculator Take Home Pay Calculator

UPB also counsels employees on insurance benefit concerns and coordinates the.

. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Your taxable income is your gross income less the standard deduction 12550 if filing single 25100 if married filing jointly or itemized tax deductions and any tax. It is usually managed by the accounting department.

686 form to reflect the redesign. Get 3 Months Free Payroll. Finally subtract your taxes and deductions from your gross pay The final step is to take your salary divide it by 12 and then subtract all of your taxes and payroll deductions.

It will help you determine the payroll deductions for your employees or pensioners. At the time of publishing these proposed changes were not law. Ad Compare This Years Top 5 Free Payroll Software.

Ad Ensure Accurate and Compliant Employee Classification for Every Payroll. You will calculate the deduction using. As we previously mentioned in addition to the specific payroll taxes related to FUTA SUTA and FICA income taxes are also calculated and withheld from payroll for most.

Employee paychecks start out as gross pay. If you put in the time at the beginning of the year to calculate your expected tax due and then keep to your quarterly. Calculating payroll deductions doesnt have to be a headache.

Timecard or timesheet is a piece of relevant information. Process Payroll Faster Easier With ADP Payroll. Subtract any deductions and.

Some pre-tax deductions reduce only wages subject to federal income tax while other deductions reduce wages subject to Social Security and Medicare taxes as well. California government employees who withhold federal income tax from wages. Get 3 Months Free Payroll.

Business income insurance can help cover these payroll costs. This number is the gross pay per pay period. The Best Online Payroll Tool.

Deductions include taxes pre-tax deductions and post-tax deductions from payroll. Time and attendance software with project tracking to help you be more efficient. Gross pay is the total amount of pay before any deductions or withholding.

Ad Calculate Your Payroll With ADP Payroll. Get Started With ADP Payroll. Ad No more forgotten entries inaccurate payroll or broken hearts.

Get the Paycheck Tools your competitors are already using - Start Now. Free Unbiased Reviews Top Picks. We recommend that you use the Payroll Deductions Online Calculator PDOC the publication T4032 Payroll.

You also need to subtract deductions from payroll. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. The State Controllers Office has updated the Employee Action Request STD.

Other gross pay contributors. UPB manages payroll schedules earnings deductions taxes and time reporting. These deductions might include insurance premiums and HSA withholdings retirement and 401k withholdings and deductions for uniform fees or meals.

Payroll Done For You. Quarterly tax payments dont have to be stressful. All Services Backed by Tax Guarantee.

Calculate Business Payroll On The Go. Ad Calculate Your Payroll With ADP Payroll. Get Payroll Custom HR Policies Onboarding Terminations Performance Management More.

Employer-sponsored plans are typically pre-tax deductions for employees. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. For the purpose of.

Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. Ad Software That Fits Your Needs. Payroll is the sum total of all compensation a business must pay to its employees for a set period of time or on a given date.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be withheld as part. For more information on deducting remitting and reporting payroll deductions go to the.

To calculate your total salary obtain your taxable wages from either Box 3 or Box 5 and add the amount to your nontaxable wages and pretax deductions which are excluded from. Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll.

Payroll for hourly workers To calculate the pay of hourly workers a few documents such as a timecard or timesheet are required. In most cases deduct the employee-paid portion of the insurance premiums before withholding any.

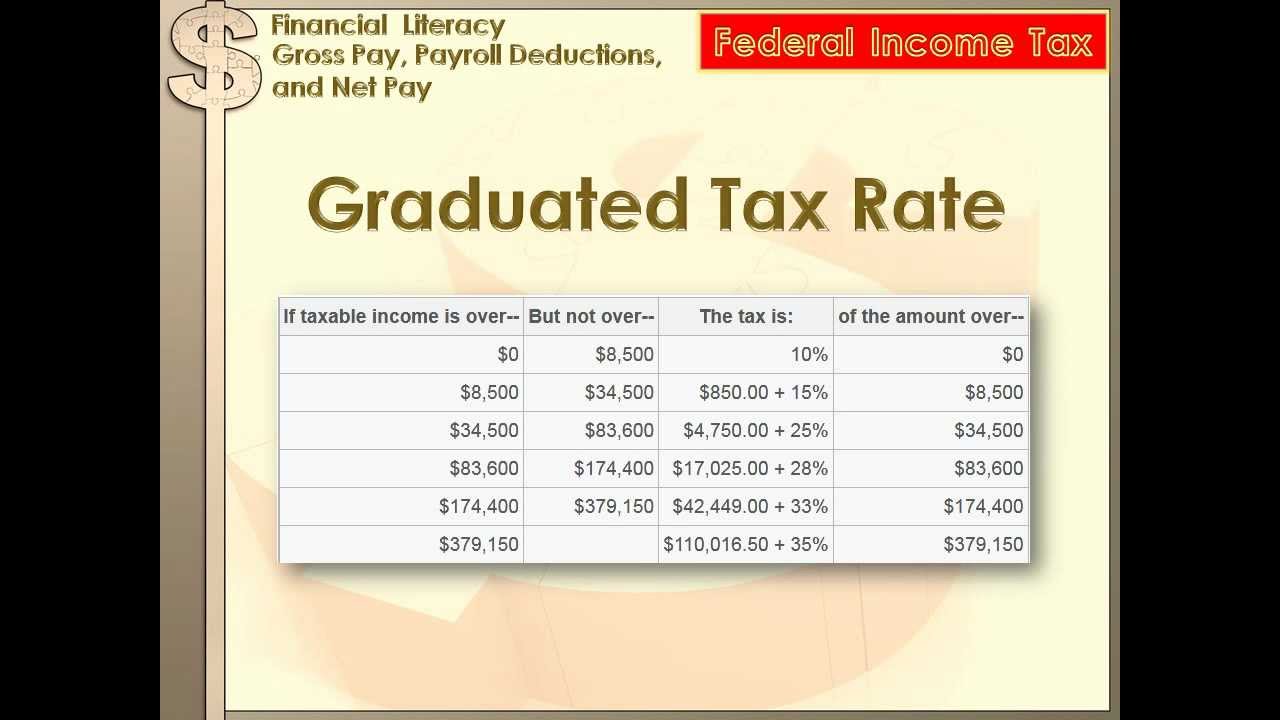

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Payroll Tax Calculator For Employers Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Enerpize The Ultimate Cheat Sheet On Payroll

Understanding Your Paycheck

Federal Income Tax Fit Payroll Tax Calculation Youtube

Solved W2 Box 1 Not Calculating Correctly

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator Take Home Pay Calculator

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com

Take Home Pay Calculator

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com